- ×

TÚI GIẶT ĐỒ LÓT 1 × ₫39.000

TÚI GIẶT ĐỒ LÓT 1 × ₫39.000 - ×

BỘ THẢM NHÀ BẾP 1 × ₫185.000

BỘ THẢM NHÀ BẾP 1 × ₫185.000 - ×

TÚI TREO ĐỒ 16 NGĂN 1 × ₫49.000

TÚI TREO ĐỒ 16 NGĂN 1 × ₫49.000

Tổng phụ: ₫273.000

The nominal interest rate is the interest rate before taking inflation into account. The most impactful nominal interest rate is the Federal Reserve funds rate. Given a fixed interest rate, an increase in the nominal interest rate will bring down inflation expectations and prevent overheating. Similarly, a decrease in the nominal interest rate can increase inflation expectations.

It is based on current and future danger-free nominal rates of interest somewhat than pure inflation, and it is used to foretell and perceive present and future spot foreign money worth actions. It shows how the money supply affects the nominal interest rate and inflation rate together. Say it pushes the country’s inflation international fisher effect formula rate to rise by 5 percentage points. As a result, the nominal interest rate of the same economy would follow suit. It may be assumed that a change in the money supply will not affect the real interest rate. Its influence illustrates the money supply’s simultaneous effect on the interest rate and inflation rate.

Currently, the IDR/USD spot rate is 14,000, and the US interest rate is 2.0%, while Indonesia is 6.0%. Currency traders use IFE to understand the reason behind currency price variations. Investors use this method to gauge the nominal interest rate required to achieve their investment objectives. Capital markets, and the lack of control on the currency for trade purposes. The facts mentioned above are entirely opposite of the mechanism in the monetary policy section. Thenationswith higher interest rates are more likely to experience depreciation in the value of their currency.

In order to adjust the nominal interest rate for inflation, we can rearrange the formula from above to estimate the real interest rate. Studies have confirmed that there are multiple other country characteristics that affect exchange rate movements besides inflation. International Fisher Effect is one of the oldest exchange-rate models used in the financial sector to determine the direction of financial markets in the future. It has been in use since the early 1900s until counter-theories against it began showing up in the early 2000s.

AJ Dvorak is Senior Publisher and Director of Trading & Investment Content at DayTradrr. He has extensive market trading expertise in stocks, options, fixed income, commodities and currencies. However, it is more common to find one at the end of an uptrend.The Gravestone Doji suffers from the same reliability issues found in stock pricing chart visual patterns. As a precaution, traders should not act on a Gravestone Doji unless the next candle provides confirmation that a reversal is actually taking place. At the day one you can buy a $ by paying Rs. 60 but after 1 year you have to pay Rs. 63 to buy a $. Ok… Now it’s example time for better understanding of above two part of this theory.

Empirical research testing the IFE has shown mixed results, and it is likely that other factors also influence movements in currency exchange rates. Historically, in times when interest rates were adjusted by more significant magnitudes, the IFE held more validity. However, in recent years inflation expectations and nominal interest rates around the world are generally low, and the size of interest rate changes is correspondingly relatively small.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. The practical application here is that if an economy’s actual inflation rate exceeds expectations, the beneficiary is the borrowers at the expense of the lenders.

Are unbiased of different monetary variables and that they provide a powerful indication of how the forex of a selected nation is performing. The International Fisher Effect is an exchange-rate model designed by the economist Irving Fisher in the 1930s. It is based on present and future risk-free nominal interest rates rather than pure inflation, and it is used to predict and understand present and future spot currency price movements. For this model to work in its purest form, it is assumed that the risk-free aspects of capital must be allowed to free float between nations that comprise a particular currency pair. For example, if an investor’s Savings Account has a nominal interest rate of 10% and a projected inflation rate of 8%, the money in his account is actually growing at 2% per year.

The Fisher effect depicts the relationship between the nominal interest rate and real interest rate. On the other hand, the International Fisher effect explains the changes in currency exchange rates using the difference in the interest rate of 2 countries. The Fisher Effect can be seen each time you go to the bank.The interest rate listed on a savings account is effectively the nominal interest rate. For example, say the nominal interest rate on a savings account is 3% and the expected rate of inflation is 2%. The smaller the real interest rate, the longer it will take for savings deposits to grow. The Fisher Effect is an economic theory that describes the relationship between nominal interest rates, inflation expectations and real interest rates.

Still, the value of our currency in comparison to the economy with low-interest rates would decrease. Inventors’ decision is highly dependent on IFE as it is a long-term predictive tool to assess the future streams from current investment in foreign assets. The IFE is efficient in knowing the future movement of currencies, depicting the representation of market behavior, and justifying capital investments in a given set of economies.

If they know that the currency of a specific country is about to appreciate, then they get ready to open long . In this way, they can determine the appropriate interest rates to charge on loans and other items. The second but very crucial limitation of the IFE is known as the uncovered interest parity. This means that, while it can make almost-accurate currency movement predictions, it has no method of telling when the effects will start.

Therefore, it is used to calculate and predict a nation’s inflation rate. The International Fisher Effect suggests that the difference in nominal rates of return causes the dissimilarity between currency exchange rates. According to Fisher, changes in inflation do not impact real interest rates, since the real interest rate is simply the nominal rate minus inflation. In the markets of currency, this effect is called the International Fisher Effect . It defines the relationship between the nominal interest rates of two countries and the rate of spot exchange for their currencies.

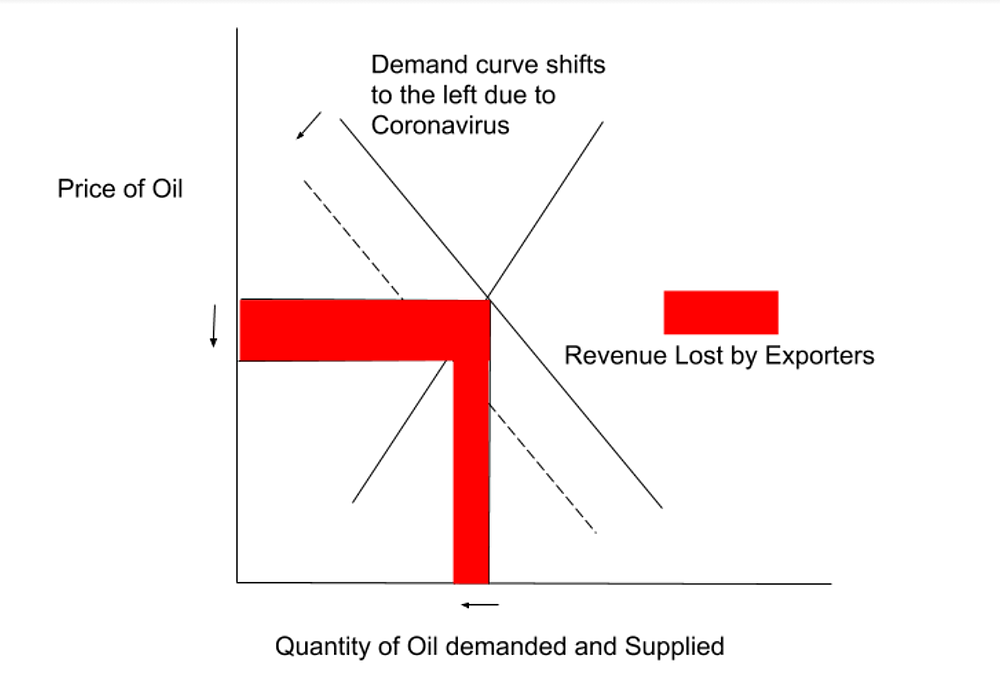

Another weak spot of the quantity concept of cash is that it concentrates on the provision of money and assumes the demand for cash to be constant. Since interest rates reflect expectations about inflation, there is a link between interest rates and exchange rates. According to the Relative Version ofPurchasing Power Parity Theory one of the factors leading to change in exchange rate between currencies is inflation in the respective countries. As long as the inflation rate in the two countries remains equal, the exchange rate between the currencies would not be affected. When a difference or deviation arises in the inflation levels of the two countries, the exchange rate would be adjusted to reflect the inflation rate differential between the countries.

This means that, from the standpoint of his buying power, the rate of growth of his savings accounts is determined by the real interest rate. The higher the actual interest rate, the more time taken by deposits to grow, and vice versa. Second, it offers undue significance to the value stage as if adjustments in prices have been essentially the most important and important phenomenon of the financial system. Third, it places a deceptive emphasis on the quantity of cash because the principal explanation for changes in the worth degree through the trade cycle. Accommodative monetary policy is an try on the enlargement of the overall cash supply by a central bank to boost an economy when development slows.

If the legislation of 1 value have been true for all items and companies, the PPP exchange fee could not be discovered from any particular person set of costs. Fifthly, change in worth degree is brought on by various factors, besides cash provide. For examinationple, an increase in price of manufacturing has an important bearing on the value stage. One of the primary weaknesses of Fisher’s amount theory of cash is that it neglects the function of the rate of curiosity as one of the causative factors between money and prices. May not be the connection a proportional one, however excessive enhance in cash provide leads to inflation.

The Fisher equation is an economic concept that defines the connection between nominal interest rates and real interest rates when inflation is included. According to the equation, the nominal interest rate equals the real interest rate and inflation added together. In mainstream macroeconomic concept, adjustments in the money supply play no function in figuring out the inflation fee. In such models, inflation is decided by the monetary coverage response operate. The zero decrease certain, along with low anticipated inflation, has prevented central banks from reducing interest rates as much as would seem appropriate.

The future exchange rate may be calculated using the nominal interest rate in two separate nations and the market exchange rate on a given day. The International Fisher Effect states that the difference between the nominal interest rates. Historically, in instances when interest rates had been adjusted by extra significant magnitudes, the IFE held extra validity. However, in recent times inflation expectations and nominal interest rates around the globe are typically low, and the dimensions of interest rate modifications is correspondingly relatively small. Direct indications of inflation charges, similar to shopper value indexes , are extra typically used to estimate anticipated adjustments in forex exchange rates. TheFisher Equation defines the relationship between nominal interest rates and real interest rates, with the difference attributable to inflation.

Thus, unexpected inflation benefits debtors, while reducing the real returns received by creditors. On the date that a financing arrangement is finalized, the inflation rate that will occur in the future is an unknown variable. Hence, the lenders in the market must use sound judgment to set expectations for future inflation to determine appropriate interest rate pricing. In the real world, the information that is provided by the IFE clearly shows the standing of individual countries. For example, if the currency of country A is expected to grow against that of country B, then the economy of country A is said to be stronger or more stable than country B. At the time of its conceptualization by Irving, all the predictive indicators in existence were purely based on interest rates.